when will i get the unemployment tax refund 2021

Property Tax Relief Programs. Prepare federal and state income taxes online.

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

2021 Federal Tax refund.

. See How Long It Could Take Your 2021 State Tax Refund. People who received unemployment benefits last year and filed tax. According to Mark Steber chief tax information officer at Jackson Hewitt Tax Service theres a way to collect unemployment benefits in 2021 as taxable income.

24 and runs through April 18. How did you file your taxes. Its not just unemployment compensation tax refunds that are going out.

Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. Which check are you inquiring about eg Social Security stimulus tax refund. The IRS controls when the tax refund for the unemployment compensation exclusion is distributed.

The amount the IRS has sent out to people as a jobless tax refund averages more than 1600. The agency had sent more than 117 million refunds worth 144 billion as. Deductions Exemptions and Abatements.

Senior Freeze Program Property Tax Reimbursement Homestead Benefit Program. To visit Alternative Press. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. Ad Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job. Is the IRS sending out unemployment refunds.

Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options. Tax season started Jan. 11 2021 Published 106 pm.

People might get a refund if they filed their returns with the IRS before Congress passed the law exempting a portion of unemployment payments from tax. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. How much will I get in unemployment tax refund.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Go to these IRS websites for information -.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. The federal tax code counts jobless benefits.

The IRS is still sending out regular 2020 tax refunds third round stimulus payments plus-up stimulus payments for those who got shorted as well as monthly advanced payments of the 2021 child tax credit. This is your tax refund unemployment October 2021 update. Can you track your unemployment tax refund.

WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent. The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. 100 Free Tax Filing.

If I Paid Taxes On Unemployment Benefits Will I Get A Refund. Refunds to start in MayIR-2021-71 March 31 2021. However there are.

The Accountant can help you figure out the status of your taxes. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year. 2021 tax preparation software.

Check For The Latest Updates And Resources Throughout The Tax Season. Can you please check status. The size of.

IRS to recalculate taxes on unemployment benefits. I have not received my 2021 refund. The IRS sends the refunds in batches to those that are eligible starting in May and throughout the summer months.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Efile your tax return directly to the IRS. COVID-19 Teleworking Guidance Updated 08032021.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

1099 G 1099 Ints Now Available Virginia Tax

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

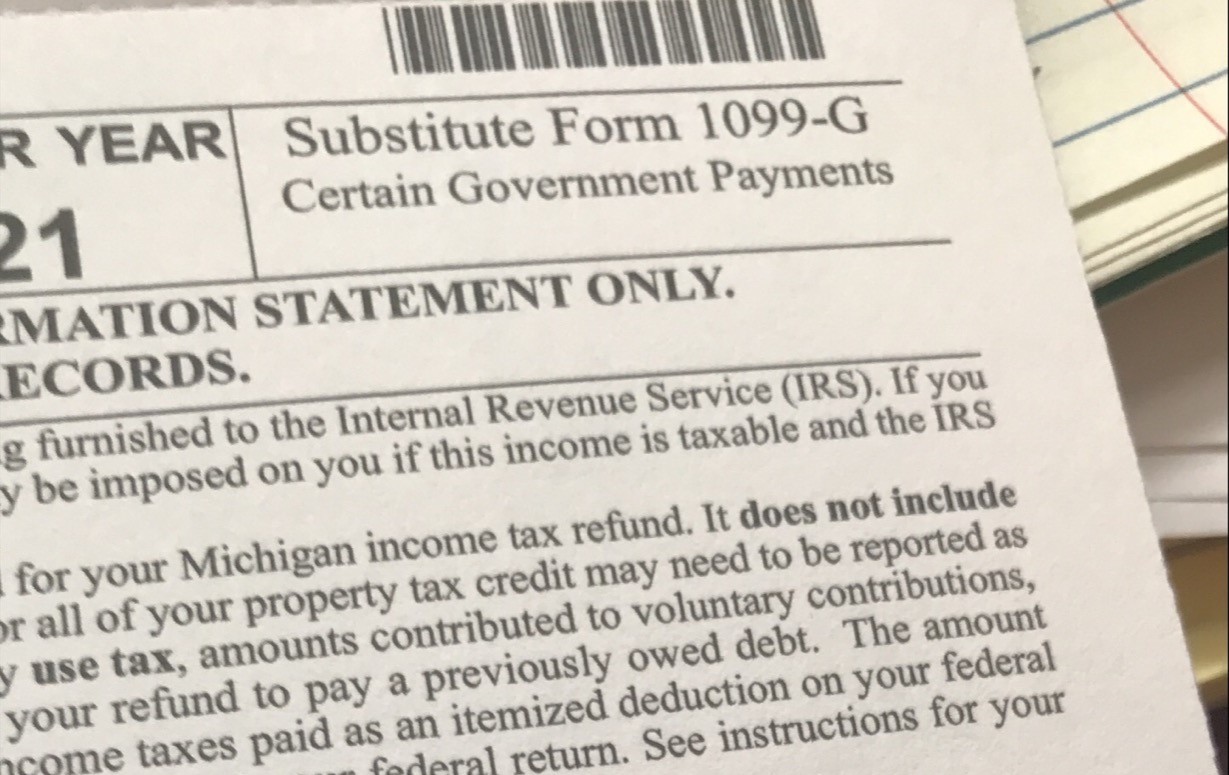

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Millions Still In Line For Tax Refunds Stimulus Payments

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post