marin county property tax rate

Payment of property taxes should be remitted to the Marin County Tax Collector Civic Center San Rafael. Ad Need Property Records For Properties In Marin County.

Calif State Forest Is Ground Zero In A Redwood Logging War

Autonomous entities in Marin County.

. Tax Rate Book 2021-2022. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711. Tax Rate Areas Marin County 2022.

The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax. Tax Rate Book 2017-2018. The first payment is due November.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. If you have questions about the following information. Ad Get In-Depth Property Tax Data In Minutes.

Start Your Homeowner Search Today. The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900. Marin County Tax Collector PO.

Information about all types of taxable residential property from real estate to boats and aircraft. Secured property tax bills are mailed only once in October. Tax Rate Book 2020-2021.

Secured property taxes are payable in two 2 installments which are due November 1. MARIN COUNTY PROPERTY OWNERS From. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

ROY GIVEN CPA Director of Finance County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax. Payment of property taxes should be remitted to the Marin County Tax Collector Civic Center San Rafael. Learn About Owners Year Built More.

Establishing tax levies estimating property worth and then receiving the tax. Find Details on Marin County Properties Fast. MARIN COUNTY PROPERTY OWNERS From.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711. Tax Rate Book 2019-2020. Overall there are three stages to real estate taxation.

County of Marin Property Tax Rate Book reports. Tax Rate Book 2018-2019. The first installment is due November 1 2010 and is delinquent after December 10.

ARROW Auditor-Controller County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax. The Tax Division includes the Property Tax and Tax Collector sectors within the Department of Finance. The Marin County Tax Collector offers electronic payment of property taxes by phone.

If you are a person with a disability and require an. DUE DATES Payment of property taxes should be remitted to the Marin County Tax Collector Civic Center San Rafael. The first installment is due November 1 2009 and is delinquent after December 10.

Property Tax Bill Information and Due Dates. Search Valuable Data On A Property. Taxing units include city county governments and various.

Box 4220 San Rafael CA 94913. For comparison the median home value in Marin County is 86800000. Martin County collects on average 091 of a propertys assessed fair.

Search Assessor Records. Such As Deeds Liens Property Tax More. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools.

Mina Martinovich Department of Finance. Information in all areas for Property Taxes. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of.

Pin On Your Ultimate Home Guide

Property Tax California H R Block

The Man Who Taught The World How To Talk Like A Pirate Piraty Kurilshiki Bajkery

Marin County Ca 4 Bedroom Homes For Sale Trulia

California Land Conservation Act Or Williamson Act County Of Fresno

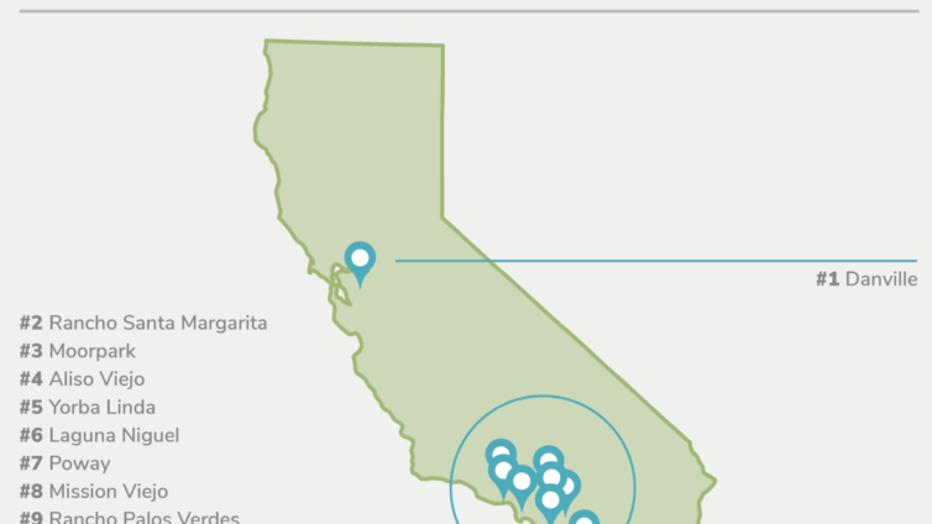

These Are California S Safest Cities According To A New Report

16816 Antelope St Esparto Ca 95627 Mls 222086810 Redfin

Customer Service Offer Letter Resume Resume Writing Samples Sample Resume

National Average 30 Year Fixed Mortgage Rates Since 1972 We Keep Hearing That Mortgage Rates Are The Lowest In Record Mortgage Rates 30 Year Mortgage 30 Years

2604 Humboldt Ave Oakland Ca 94602 Trulia

Apartment Building Under Construction On Sunny Day In 2022 Apartment Building Commercial Construction Construction

California Housing Market Forecast 2022 Forecast For Home Prices Sales Managecasa

Marin Residents Have Until Monday To Pay Property Taxes

Pin On Rentals In The Bay Area

Marin County Ca 4 Bedroom Homes For Sale Trulia

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House We Buy Houses

Amid Housing Crisis California Cities Look To Target Vacant Homes With Taxes Courthouse News Service